LA Pay now offers powerful customization options for verifying new credit cards. These settings give you granular control over how the system validates cards, improving transaction success rates while reducing fraud risk.

Understanding the Core Concept

Whenever a new credit card is added (for use in future transactions), you can now choose to enforce specific verification checks. This helps ensure that only authorized cards are used, protecting both your business and your customers.

Available Verification Settings

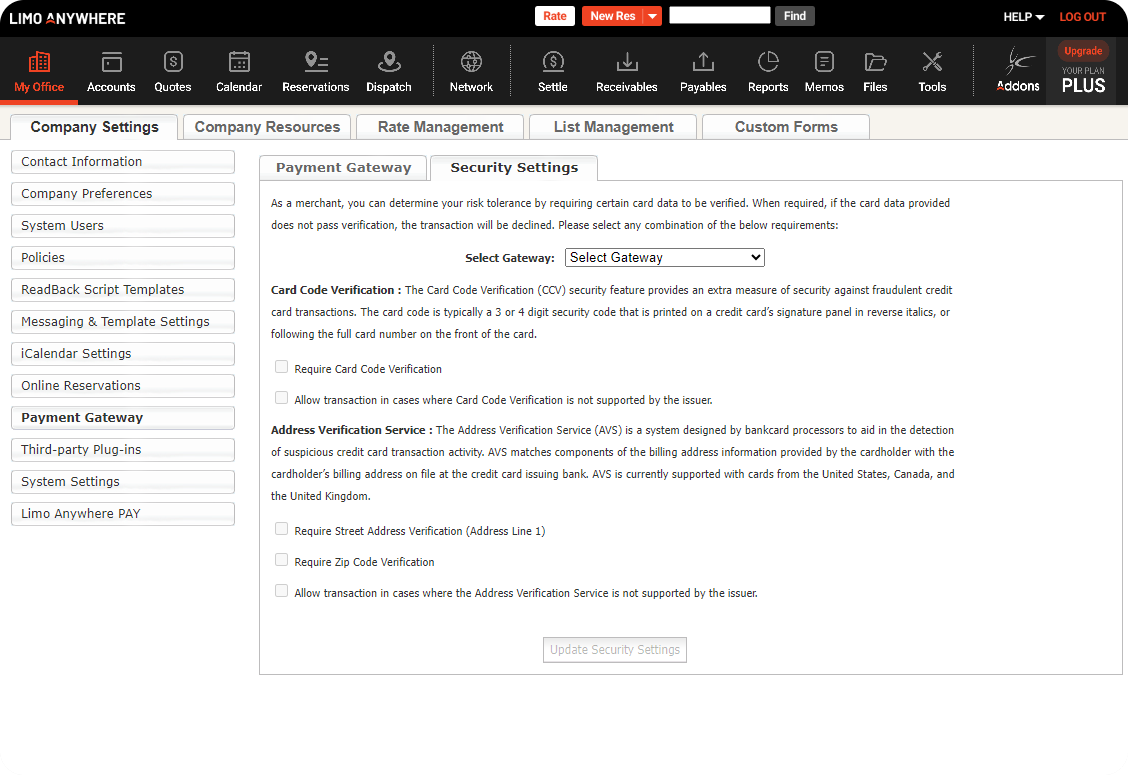

The settings are located at “My Office” -> “Company Settings” -> “Payment Gateway” -> “Security Settings”. Here’s a breakdown of each setting:

Address Verification Settings (AVS)

Require Street Address Verification (Address Line 1):

This setting mandates that the complete street address (including building number) provided by the customer must exactly match the address the card issuer (i.e., the bank) has on file for that card.

If you enable this setting, providing a street address becomes mandatory whenever a customer adds a new card anywhere within the LA Pay system.

Require Zip Code Verification:

Ensures that the zip code provided by the customer matches the corresponding zip code associated with the card on the card issuer’s records.

Allow Transactions Where Address Verification Isn’t Supported:

In certain cases, some cards (or the countries where they are issued) do not have full AVS compatibility.

Enabling this setting allows you to still accept these cards but acknowledges a slightly elevated risk since the address cannot be fully verified.

Card Code Verification Settings (CVV)

Require Card Code Verification:

Enforces a check of the 3-4 digit security code (CVV) found on the back of the credit card. This must match the issuer’s records for the card to be accepted into LA Pay.

Allow Transactions Where Card Verification Isn’t Supported:

Very rarely, a card might not have a CVV code.

Enabling this setting allows for those card types, again acknowledging a slightly higher risk since the code cannot be used for verification.

Important Notes

Automatic $1 Authorization Hold: When a new card is added (for future use), LA Pay temporarily authorizes $1 to confirm the card’s validity. This hold is automatically released. It’s a crucial process that significantly improves the chances of successful future transactions using that card.

Platform-Wide Application: The AVS/CVV settings you choose will be enforced throughout the entire LA Pay system, including ORES, the PWA, Payment Requests, etc.

Why Use These Settings?

Implementing card verification based on your chosen settings offers several benefits:

Fight Fraud: Rigorous verification makes it much harder for unauthorized cards to be added to your system.

Reduce Incorrect Declines: Prevent valid cards from being mistakenly rejected due to minor data discrepancies.

Let Us Help!

If you have any questions about configuring LA Pay’s new AVS/CVV settings or need further guidance, please contact our support team.